Pricing Model

Details of our Interchange++ pricing model.

Overview

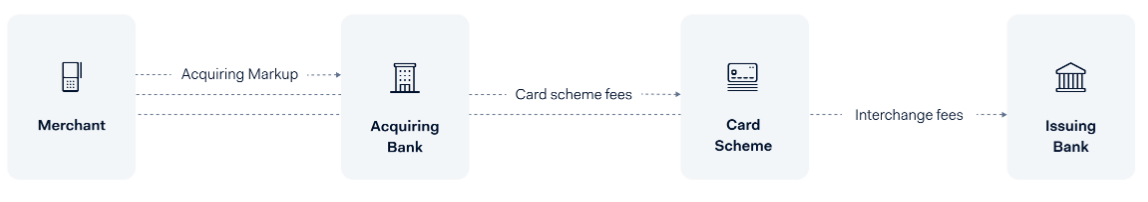

Our transparent price plans are based on industry-wide Interchange++ model. We charge you a payment processing fee and a payment method fee for each transaction when you accept a payment.

👉 Interchange represents the interchange fee (Bank Commissions).

👉 Τhe first ’+’ represents the payment scheme fee, which is usually lower than the interchange fee, this fee may vary depending on the location, security of the transaction or card type.

👉 Τhe second ’+’ represents the Viva acquiring fee, which depends on the type of your activity, your country of registration and your company’s total sales by payment scheme.

In the European Union, the interchange fee for debit cards issued by European issuers are 0.2% and cover the majority of transactions processed. These fees are described in more detail on the Visa / Mastercard.

Interchange++ Model (IC++)

| Interchange fee (IC) | Scheme fee (+) | Acquirer fee (+) |

|---|---|---|

| This fee is paid by the merchant bank (acquirer) to the customer’s bank (issuing bank). | This fee is charged by card organizations such as Visa or Mastercard® for handling and processing payment. | This fee covers the acquiring service charged by the merchant bank (acquirer) for facilitating card payments. |

Get Support

If you would like to integrate with Viva, or if you have any queries about our products and solutions, please see our Contact & Support page to see how we can help!