EPS

Information on the EPS payment method.

- Introduction

- User Experience

- Details

- How to activate EPS

- Merchant Categories

- Payment method messaging

- Get Support

Introduction

Electronic Payment Standard (EPS) is a payment method allowing Austrian customers to pay via fast and easy direct bank transfers.

Some of the main benefits of offering EPS as a payment method are:

- Popularity: EPS is the most popular bank transfer payment method in Austria

- Speed and ease of use: Customers can quickly and easily log into their chosen bank and complete a payment

- Wide availability: A wide variety of banks support EPS, making it a convenient option

- Security: Every payment is authorised securely within the bank’s environment

- Get started quickly: There is no need for the merchant to have an account with EPS

User Experience

Screenshots

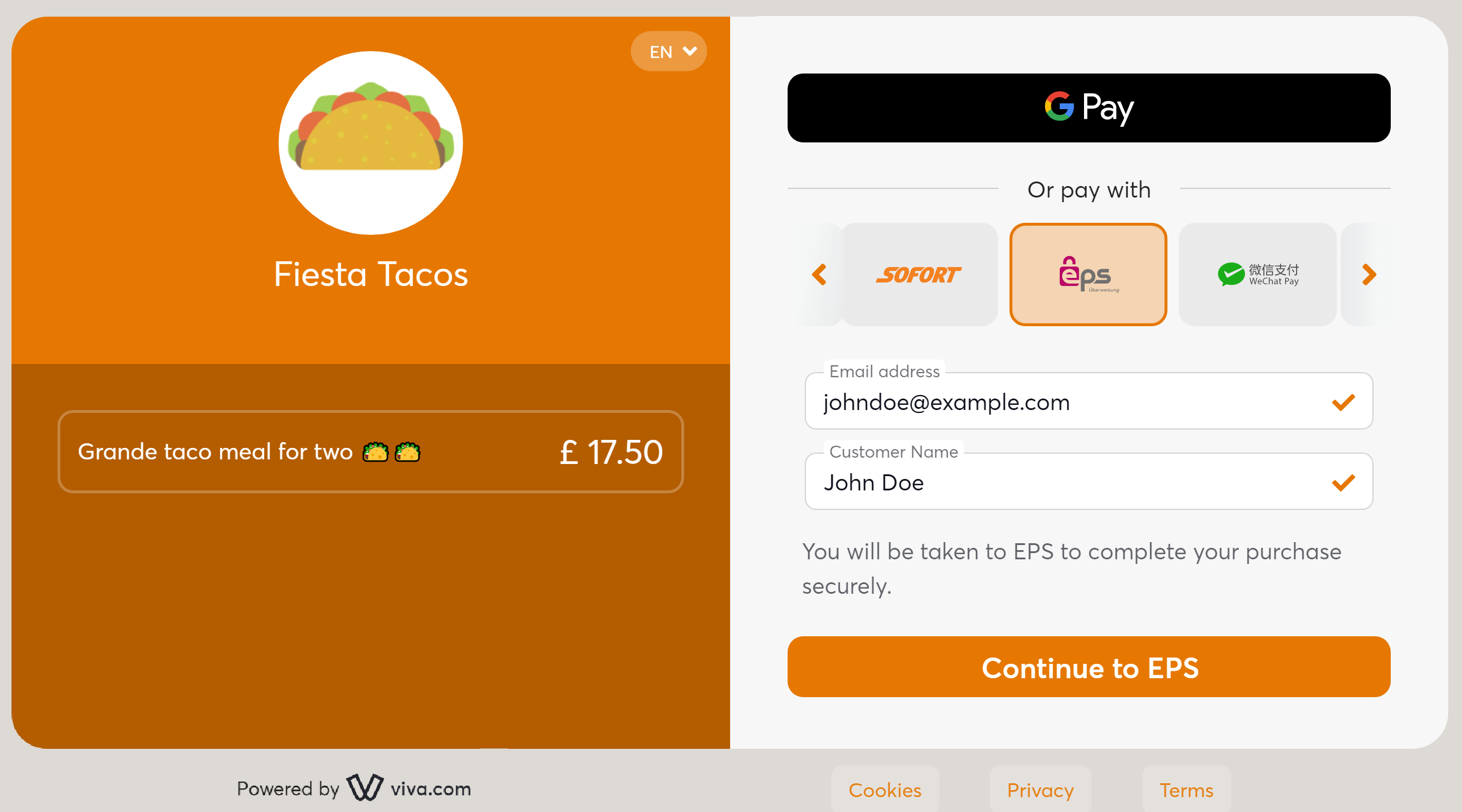

At the checkout page, the customer chooses EPS as their preferred payment method:

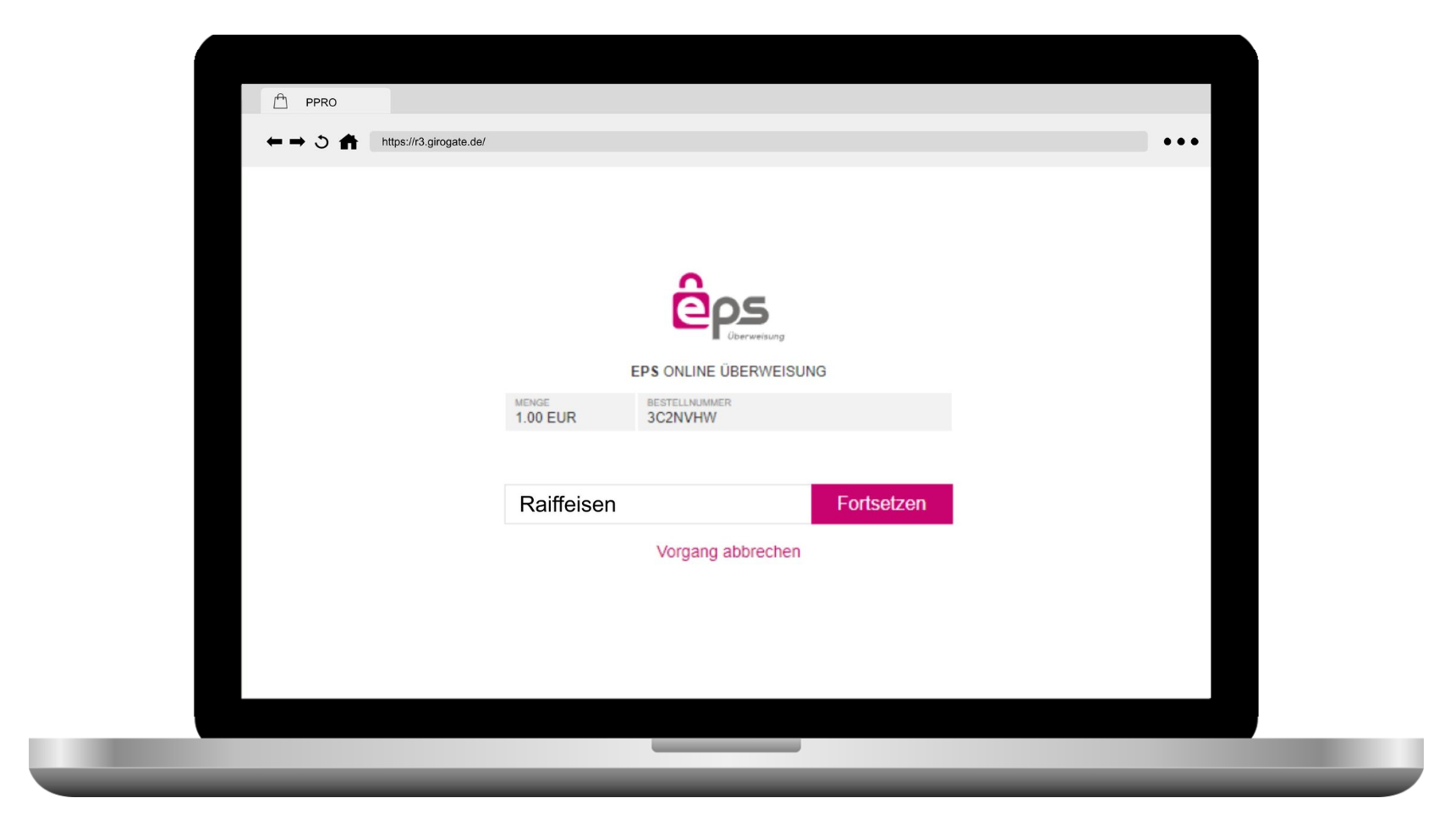

The customer is directed to an EPS page which displays a summary of the transaction. They select their preferred bank and click ‘Continue’:

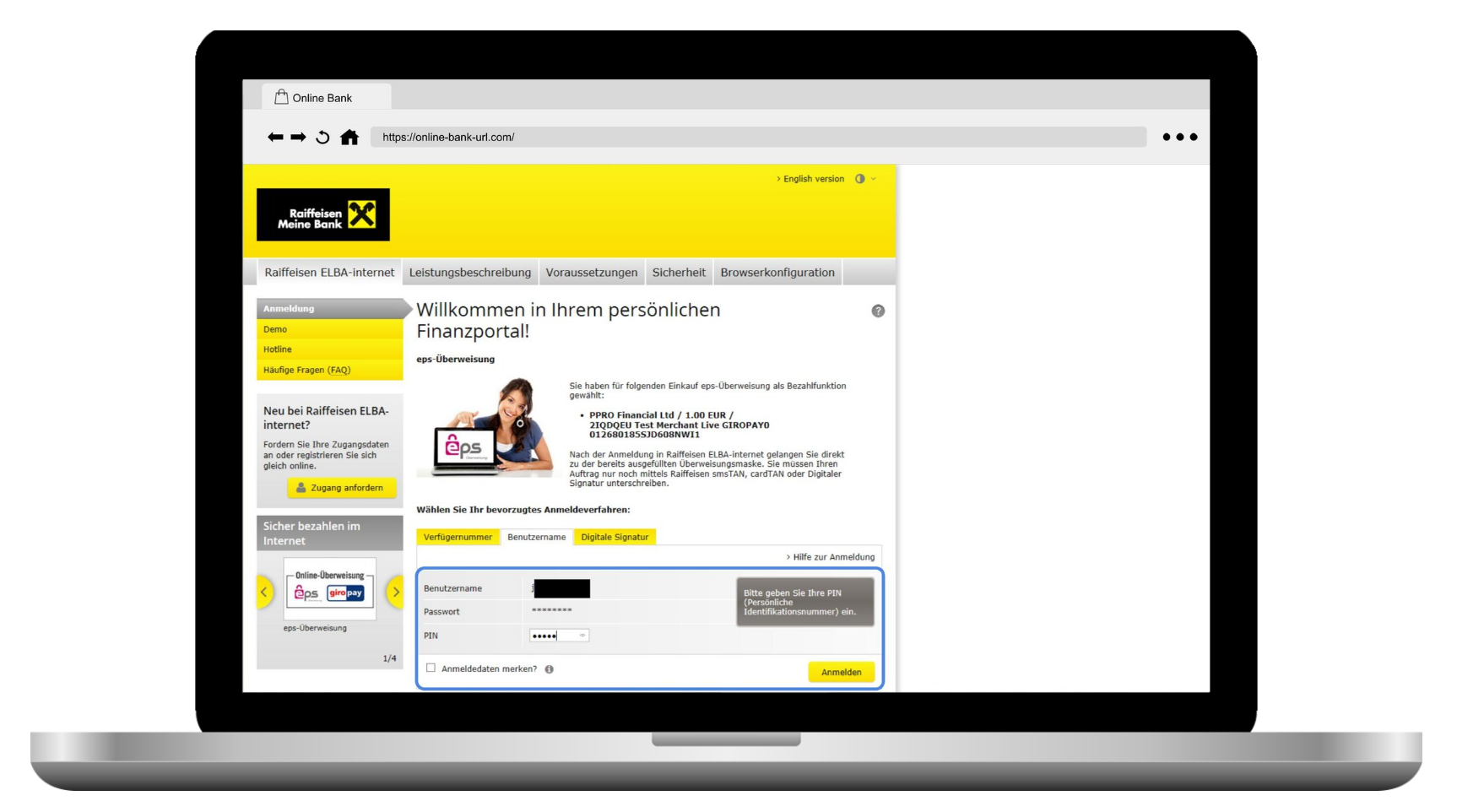

They are then redirected to their bank’s online environment to log in with their account credentials:

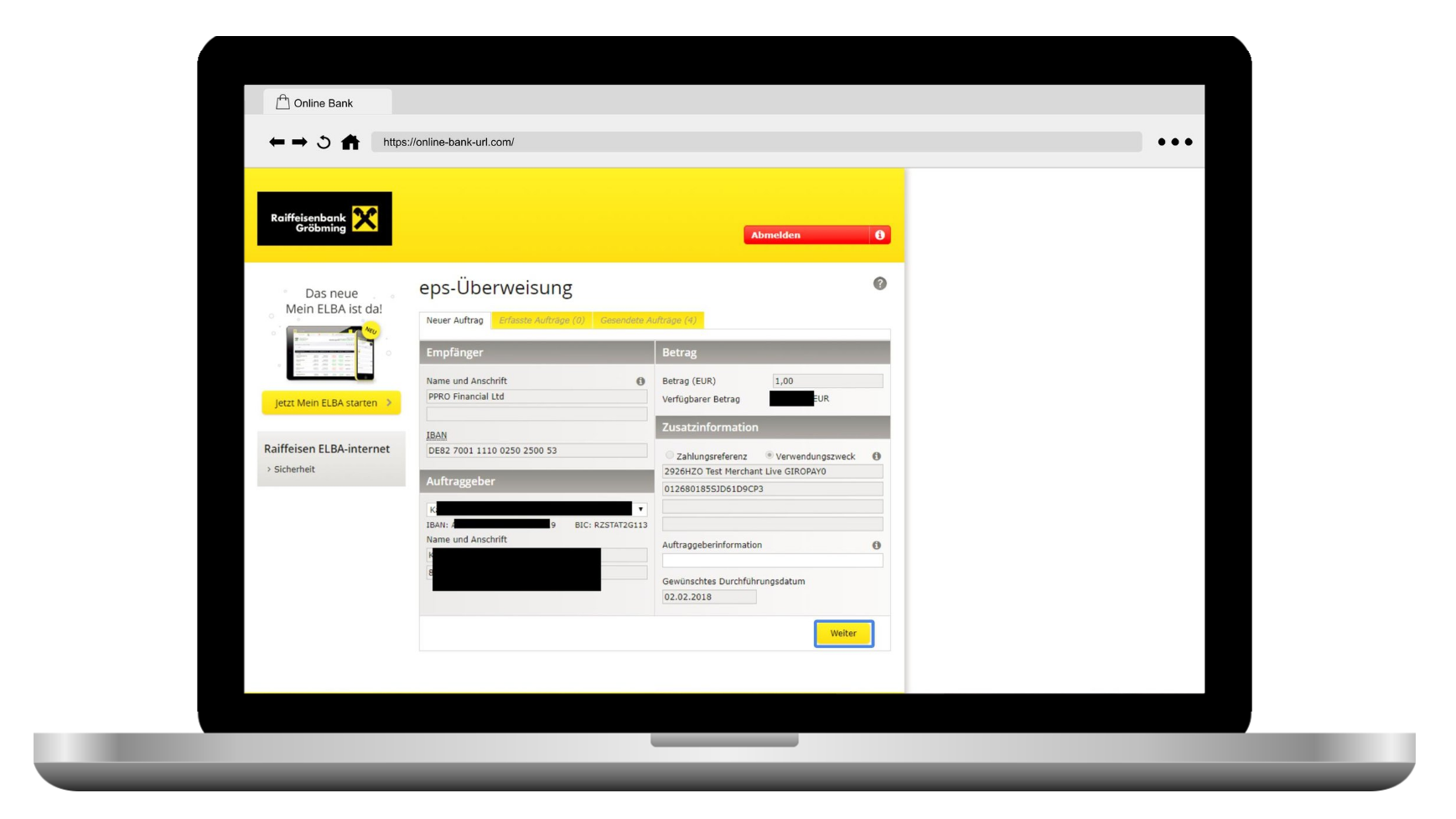

After logging in, the customer can review the transaction before clicking ‘Continue’:

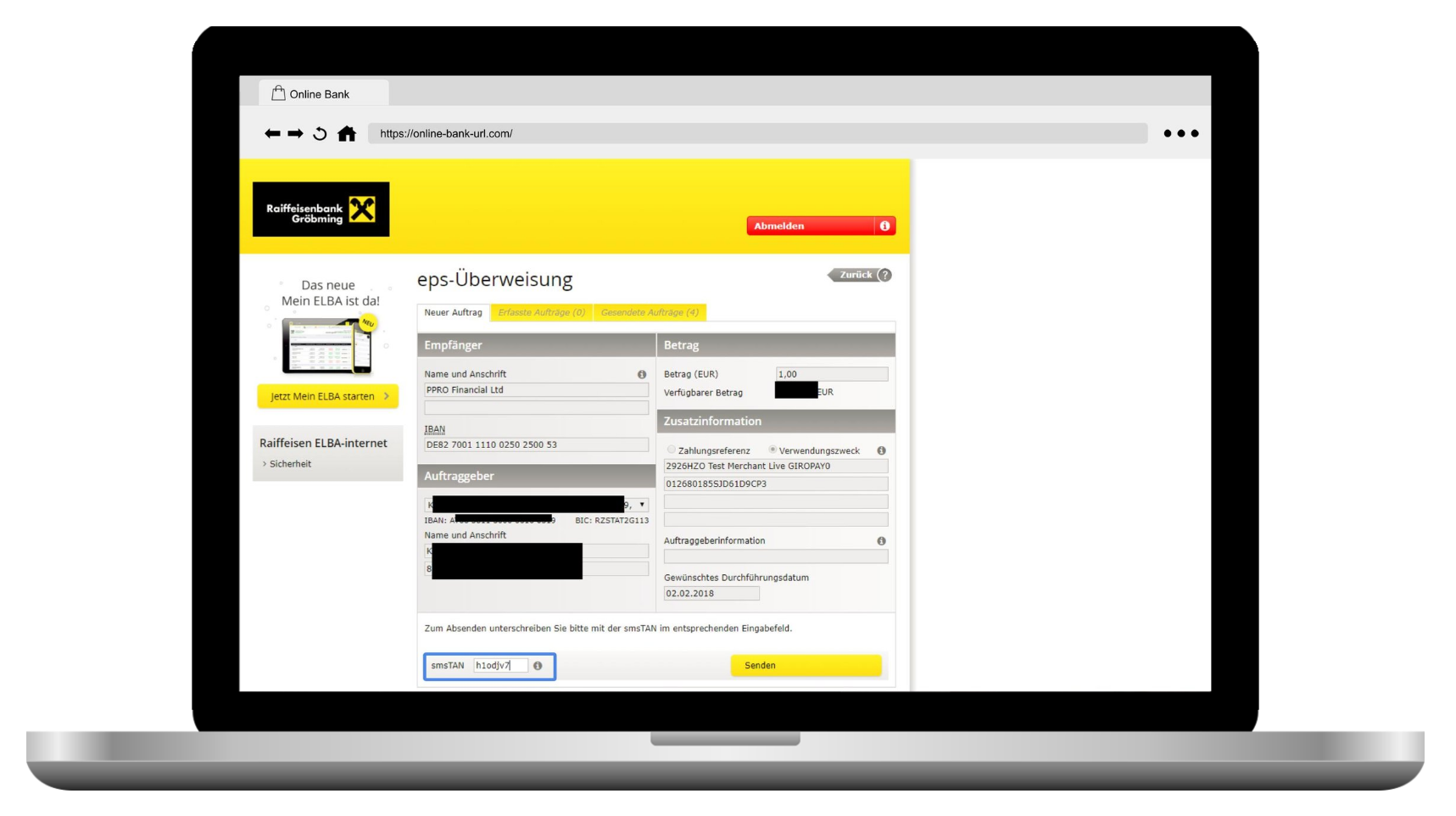

The customer then authorises the transaction via Secure Customer Authentication, such as an SMS code:

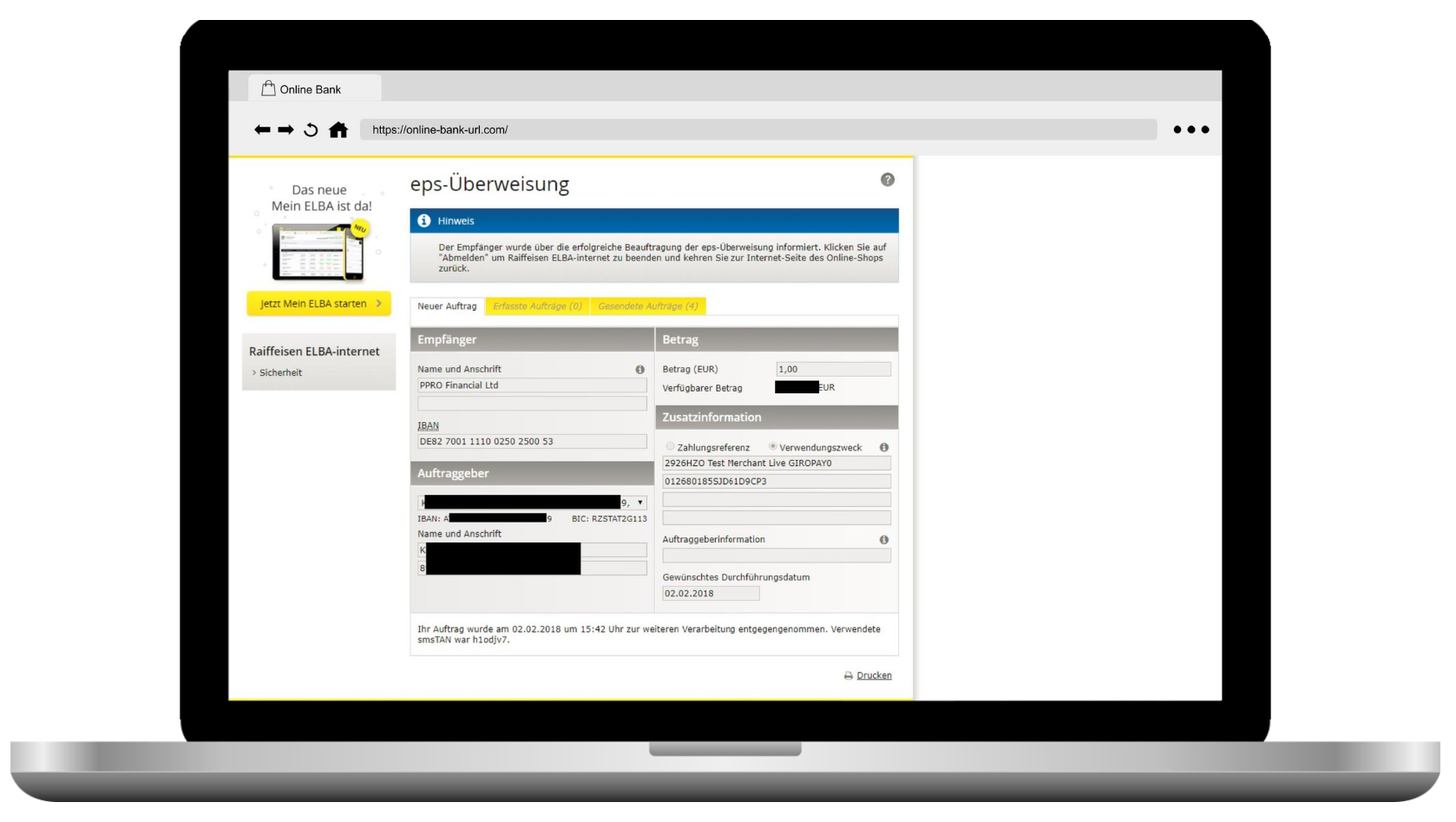

The transaction success is confirmed on the bank’s page and the merchant is notified:

Videos

Please also see our videos below, outlining the desktop and mobile use of EPS:

Desktop:

Mobile:

Details

Merchants do not need to have an account with EPS

- How to activate: Please refer to the How to activate section below

- Payment method type: Asynchronous - payments are not confirmed immediately, it may take up to 1 hour to receive confirmation of payment. You need to set up webhooks in order to get notified for asynchronous payments

- Refunds: Supports partial and full refunds

- Recurring payments: Not yet supported

- Pre-authorizations: Not yet supported

- Restricted MCC: Some Merchant Categories are not eligible to have EPS activated

- Μerchant countries: Available for merchants registered in Austria, Belgium, Croatia, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, Netherlands, Portugal & Spain

- Customer countries: Available to customers in Austria only

- Pricing: Please refer to our pricing page under the main navigation for more information

- Settlement: Customer payments are deposited next day into your business account for confirmed payments / successful transactions (i.e. have statusId = F)

- Cross-currency payments: Not yet supported

- Additional notes: The Email address and Customer Name fields within Smart Checkout are optional

- ISV: Supports ISV Program

How to activate EPS

Merchants do not need to have an account with EPS

| Environment | Activation details |

|---|---|

| Production | This payment method is available upon positive review of your request. For more information, please contact your Viva sales representative. Alternatively, you can contact us directly via our live chat facility which can be found in your *Production* Viva self-care account. *You may visit our Test Cards and Environments page for further information on how to make test payments with EPS. |

| Demo |

Merchant Categories

There are some merchant categories that are not eligible to have EPS activated. If your business is in one of these categories, you will not be able to accept payments through EPS:

| Merchant Category (MCC) | Description |

|---|---|

| 5094 | Precious Stones and Metals, Watches and Jewelry |

| 5122 | Drugs, Drug Proprietors, and Druggist’s Sundries |

| 5499 | Misc. Food Stores – Convenience Stores and Specialty Markets |

| 5912 | Drug Stores and Pharmacies |

| 5962 | Direct Marketing – Travel Related Arrangements Services |

| 5966 | Direct Marketing- Outbound Telemarketing Merchant |

| 5967 | Direct Marketing – Inbound Teleservices Merchant |

| 5999 | Miscellaneous and Specialty Retail Stores |

| 7322 | Debt collection |

| 7996 | Amusement Parks, Carnivals, Circuses, Fortune Tellers |

| 9223 | Bail and Bond Payments |

Payment method messaging

It is important that the customer is aware of the payment methods you offer via Smart Checkout, as this will increase conversion and average order values. Please see our payment method messaging guide for more details on why and where we would recommend adding this information to your site.

If desired, you can download and use this icon on your site or online store, in order to show customers you offer EPS as a payment method:

Get Support

If you would like to integrate with Viva, or if you have any queries about our products and solutions, please see our Contact & Support page to see how we can help!