Account Transaction Created

Notification of an account transaction.

- Overview

- Webhook configuration

- Response example

- Webhook body

- SubType Ids of transactions

- Get Support

Overview

This webhook will be triggered when the wallet/bank account balance changes for any reason, such as the below events:

- Successful payments 1

- Refunds

- Pay Outs

- OCTs (Original Credit Transactions)

- Wallet transfers

- Bank transfers (incoming or outgoing)

- Expenses purchases from a card (digital or physical) 2

- Disputes

- Ordering of a physical card

- Instant payment(s) clearance

- Card terminal subscription fees deduction

- Reseller fees deduction

- Loan fees deduction

- Chargebacks

Webhook configuration

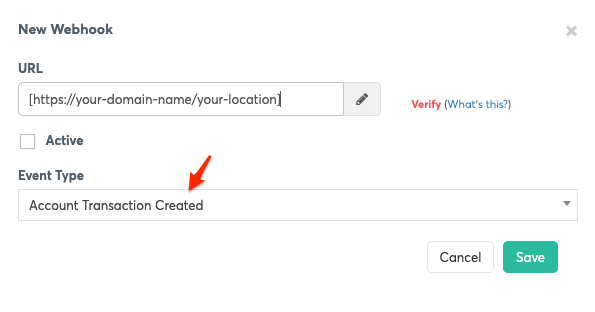

To enable in the viva banking app:

Log in to Viva, demo or live , and select the required account.

Visit Settings > API Access > Webhooks.

Click on the Create Webhook link.

The New Webhook dialog box is displayed.Enter your webhook URL in the URL field.

Click on the Verify link.

If verified successfully, a confirmation message is displayed.Choose Account Transaction Created from the Event Type dropdown:

Select the Active checkbox to activate notifications.

Click on the Save button.

Response example

You may find below the sample response with EventTypeId 2054.

{

"Url": "Your webhook URL",

"EventData": {

"Tag": "PayOutIbanReversal",

"Iban": null,

"PersonId": "11ac9cd4-c9ea-48d3-b414-1f10ce664aad",

"WalletId": 2263446434318,

"BankId": null,

"ParentId": "a787e1bb-8101-4043-8618-3b962d8f6cfc",

"Amount": -100.4, //Amount in EUR, GBP, ZLOTY, ETC.

"IsInternal": false,

"StatusId": "F",

"Created": "2022-05-26T03:01:42.457",

"CardNumber": null,

"Description": "Wallet2Wallet Transfer - Merchant Trade Name - [Optional text to show on account statement]",

"ValueDate": null,

"BankAccountId": null,

"CurrencyCode": "978",

"TargetAmount": 10,

"SaleTransactionId": null,

"TargetReserved": 0,

"TargetAvailable": 10,

"TargetOverdraft": 0,

"WalletTransactionId": "6fb74d4a-aa92-4920-a759-49a703834c03",

"WalletFriendlyName": "Primary",

"InternalDescription": null,

"TypeId": 20,

"SubTypeId": 140

},

"Created": "2022-05-26T00:01:42.4752623Z",

"CorrelationId": "22-146-51FB37DB",

"EventTypeId": 2054,

"Delay": null,

"RetryCount": 0,

"RetryDelayInSeconds": null,

"MessageId": "82606171-a5a3-4330-8a86-548b4344f451",

"RecipientId": "11ac9cd4-c9ea-48d3-b414-1f10ce664aad",

"MessageTypeId": 512

}Webhook body

You can find below the body parameters of this webhook

| Parameter | Description | Example |

|---|---|---|

| Tag | The tag that triggered for this event | |

| Iban | The Iban the wallet owner sent a bank transfer to | null |

| PersonId | The Id of the person/merchant that initiated the action, or who billing created an obligation for | bdf4c6b3-c26d-4046-b5df-5c443ec39d09 |

| WalletId | The wallet from which the transaction was initiated | 657297971060 |

| BankId | Bank's ID | null |

| ParentId | The parent TransactionId (if any) of the current transaction | d1b9242b-5665-44a0-903b-7325b235ca2f |

| Amount | The signed amount of the transaction. Represents the total funds paid by the customer and includes TotalFee (when applicable) | -100.4 |

| IsInternal | True, if the wallet Trn was created through internal viva operations | false |

| StatusId | The status id indicates the transaction’s status. |

F = Finished A = Active C = Captured E = Error R = Refunded X = Cancelled M = Claimed MA = Claim Awaiting Response MI = Claim In Progress ML = Claim Lost MS = Suspected Claimed MW = Claim Won |

| Created | Transaction's creation timestamp | 2021-11-04T17:30:24.363 |

| CardNumber | The card number used (applicable for card related transaction types) | null |

| Description | This description is related to the wallet transaction | Transfer Wallet2Wallet - George Popa - Test Description |

| ValueDate | The settlement date of the bank transfer, if the wallet Trn was created from a bank transfer | null |

| BankAccountId (uuid) | null | |

| CurrencyCode | The currency of the transaction in ISO 4217 numeric format (e.g. “978” for Euro) | 978 |

| targetAmount | Wallet amount after the execution of this transaction | 10 |

| SaleTransactionId | The transaction id which is matched to the wallet transaction which generated this event. (e.g. a paid order which resulted in a balance change of a wallet) | null |

| targetReserved | Reserved amount | 10 |

| targetAvailable | Available amount after the execution of this transaction | 10 |

| targetOverdraft | Overdraft amount | 10 |

| WalletTransactionId | The Id of the wallet transaction that was created as a result of this transaction | ea312e33-25ef-4858-886f-6298898f4249 |

| WalletFriendlyName | The wallet name that given to it | ea312e33-25ef-4858-886f-6298898f4249 |

| InternalDescription | This description is related to the wallet transaction. If the payment is linked with an RF payment (applied only for Greek merchants) then this parameter will be filled with th RF code. | null |

| TypeId | The wallet typeId | Possible values are the below: |

| SubTypeId | SubType Id of the transaction | Please see the below table for all SubType ids and their descriptions. |

| RetryCount | The count of the retries where Viva.com is triggering the webhooks | 0 |

| RetryDelayInSeconds | Specify the delay between the retries where Viva.com is triggering the webhooks | null |

SubType Ids of transactions

When receiving information about a transaction via the Account Transaction Created webhook, certain transaction feedback parameters can be found in the webhook body. In particular, the SubTypeId parameter is used to return information related to the source of the transaction. For more details, please see the SubTypeId, Name and Description columns below.

| SubTypeId | Name | Description |

|---|---|---|

| 2 | FeeChargeBack | This is a fee applied to a customer for losing a dispute/chargeback. |

| 3 | FeePayOutCard | This is a fee applied to a customer for sending money from their account to a Visa or Mastercard card. |

| 4 | FeePayOutIban | This is a fee applied to a customer for sending money from their account to an IBAN account (outside of VW ecosystem). |

| 5 | FeeSalesCommission | This is a fee applied to a customer for accepting payments on their Viva account. |

| 6 | FeePayInCash | This is a fee applied to a customer for topping up their account balance via cash at Viva Spots. Viva Spots are a reseller network (gas stations, supermarkets, etc) and currently is only available to Greece. |

| 7 | FeePayInDias | This is a fee applied to a customer for topping up their account balance via DIAS. |

| 8 | FeePayInCard | This is a fee applied to a customer for topping up their account balance via a card. |

| 9 | FeePayInVoucher | This is a fee applied to a customer for topping up their account balance via an e-money code. E-money codes can be purchased at Viva Spots. |

| 10 | FeeWalletCharge | This is a fee applied to a customer for paying with their Viva balance and they have to pay an extra fee. E.g. during a bill payment scenario. |

| 11 | FeeCashCommission | This is a fee applied to a customer for accepting cash payments on their Viva account. |

| 12 | FeeDiasCommission | This is a fee applied to a customer for accepting payments via DIAS payment codes on their Viva account. |

| 13 | FeeCardCommission | This is a fee applied to a customer for accepting card payments. |

| 14 | FeeWalletCommission | This is a fee applied to a customer for accepting payments via Pay with Viva. |

| 15 | FeeAliPayCommission | This is a fee applied to a customer for accepting AliPay payments. |

| 16 | FeeOnDemandClearance | This is a fee applied to a customer for having their funds instantly cleared to their account (normal schedule is usually next day settlement). |

| 18 | FeeWithdrawal | This is a fee applied to a customer for wirthdrawing funds from their account's balance. |

| 19 | FeeAlternativePaymentsCommission | This is a fee applied to a customer for accepting card payments through alternative payment methods (different per country, e.g. Paypal). |

| 20 | PayInCash | This is a credit transaction equal to the top-up amount applied to a customer when topping up their balance via cash. |

| 21 | PayInDias | Incoming bill payments. |

| 22 | PayInCard | This is a credit transaction equal to the top-up amount applied to a customer for topping up their account balance via a card. |

| 23 | PayInVoucher | This is a credit transaction equal to the top-up amount applied to a customer for topping up their account balance via an e-money code. |

| 24 | PayInSmartMoney | This is a credit transaction equal to the top-up amount applied to a customer for topping up their account balance via an Smart Money voucher. |

| 25 | PayInIban | This is a credit transaction equal to the top-up amount applied to a customer for topping up their account balance or receiving funds via IBAN transfer. |

| 30 | PayOutIban | This is a debit transaction equal to the amount of money a customer sent from their account to an IBAN account. |

| 31 | PayOutCard | This is a debit transaction equal to the amount of money a customer sent from their account to a card. |

| 32 | PayOutDirectDebit | This is a debit transaction equal to the amount of money a customer paid via SEPA Direct Debit. |

| 80 | ClearanceOther | The clearance process for other payment types has been executed. |

| 81 | ClearanceCash | The clearance process for cash payments has been executed. |

| 82 | ClearanceDias | The clearance process for Dias payments has been executed. |

| 83 | ClearanceCards | The clearance process for card payments has been executed. |

| 84 | ClearanceWallet | The clearance process for Pay with Viva Wallet payments has been executed. |

| 85 | ClearanceResellerFee | The clearance process for Reseller Fees has been executed. |

| 86 | ClearanceAliPay | The clearance process for Alipay payments has been executed. |

| 87 | ClearanceAlternativePayments | The clearance process for alternative payment types has been executed. |

| 100 | CardPurchase | A debit transaction has been made using a Viva Debit card. |

| 101 | CardPurchaseReserve | Used for reserving available balance between authorisation and clearance of a CardPurchase. |

| 102 | CardPurchaseReserveAdvice | This is similar to CardPurchaseReserve. |

| 103 | CardPurchaseUnreserve | Used for releasing available balance between authorisation and clearance of a CardPurchase. |

| 104 | CardPurchaseWithCashBack | A CardPurchase has been made with CashBack withdrawn. |

| 105 | CardPurchaseWithCashBackReserve | Used for reserving available balance between authorisation and clearance of a CardPurchase with CashBack. |

| 106 | CardPurchaseWithCashBackReserveAdvice | This is similar to CardPurchaseWithCashBackReserve. |

| 107 | CardPurchaseWithCashBackUnreserve | Used for releasing available balance between authorisation and clearance of a CardPurchase with CashBack. |

| 108 | CardWithdrawal | A cash withdrawal has been made using a Viva Debit card at an ATM. |

| 109 | CardWithdrawalReserve | Used for reserving available balance between authorisation and clearance of a CardWithdrawal. |

| 110 | CardWithdrawalReserveAdvice | This is similar to CardWithdrawalReserve. |

| 111 | CardWithdrawalUnreserve | Used for releasing available balance between authorisation and clearance of a CardWithdrawal. |

| 112 | CardCashDisbursement | A cash withdrawal has been made using a Viva debit card at a POS. |

| 113 | CardCashDisbursementReserve | Used for reserving available balance between authorisation and clearance of a CardCashDisbursement. |

| 114 | CardCashDisbursementReserveAdvice | This is similar to CardCashDisbursementReserve. |

| 115 | CardCashDisbursementUnreserve | Used for releasing available balance between authorisation and clearance of a CardCashDisbursement. |

| 116 | CardPurchaseReturn | A refund has been made to a Viva Debit card. |

| 117 | CardPayment | A credit transaction (such as OCT) has been made towards a Viva cardholder. |

| 140 | WalletTransfer | A wallet transfer has been made (sent or received from another account). |

| 141 | WalletCharge | A customer payment (charge) has been made via the Pay with Viva Wallet payment method. |

| 142 | WalletRefund | A customer refund has been made via the Pay with Viva Wallet payment method. |

| 143 | WalletTransactionReserve | Used for reserving available balance linked to transactions made via the Pay with Viva Wallet payment method. |

| 144 | WalletTransactionUnreserve | Used for releasing available balance linked to transactions made via the Pay with Viva Wallet payment method. |

| 146 | WalletManualAdjustment | A debit or credit transaction used internally in case of ad-hoc, non-automated processes. |

| 147 | WalletFundsReserve | This is a transaction used to hold available funds from being used from a customer. |

| 148 | WalletFundsUnreserve | This is a transaction used to release available funds to a customer. |

| 149 | WalletFundsConfiscation | This is a debit transactioned used to confiscate funds from a customer in case of regulatory duty. |

| 150 | WalletSmartMoneyIssue | This is a debit transaction used when a customer issues a Smart Money voucher. The amount equal to that of the Smart Money Voucher. |

| 151 | WalletSmartMoneyServiceFee | This is a fee applied to a customer for issuing a Smart Money voucher. |

| 152 | WalletSubscriptionDevice | This is a debit transaction applied to a customer account as a subscription fee for having a POS card terminal from us. |

| 154 | WalletSubscriptionPackage | This is a debit transaction applied to a customer account as a subscription fee for having a certain feature (package). |

| 156 | WalletPricingCashback | This is a credit transaction applied to a customer when they win cashback for using their Viva card to pay for expenses. The cashback amount relates to acquiring fee of the customer. |

| 157 | WalletObligationReserve | This transaction is used for collecting money from a customer. Even if they don't have available funds at the time of this transaction, once funds are there they will be held from the customer. |

| 158 | WalletObligationUnreserve | This transaction is used for releasing funds to customer previously held with 157. |

| 159 | WalletObligation | This is a debit transaction used for capturing funds from a customer account, that were previously held with 157. |

| 160 | WalletIssuingPartnerSettlement | Used in white-label issuing scenario. Used to settle funds with the card scheme using funds from the Issuing Partner. |

| 162 | SaleTransactionReserve | This is a transaction used to hold from a customer available funds linked to a payment they accepted. |

| 163 | SaleTransactionUnreserve | This is a transaction used to release to a customer available funds linked to a payment they accepted and were previously held with SaleTransactionReserve. |

| 164 | ManualAdjustmentMoneyOutToIban | This is a debit transaction used from Finance to emulate a payment transfer that is not automatically processed and needs to be manually executed from them. |

| 165 | ManualAdjustmentMoneyOutToIbanFee | This is a fee applied to a customer for sending money from their account to an IBAN account (outside of VW ecosystem) but the transaction was executed manually from Finance. |

| 166 | ManualAdjustmentOtherAmount | This is a debit or credit transactionis used from Finance for scenarios that are not automated from a system. |

| 167 | ManualAdjustmentOtherFee | This is a debit transaction used from Finance to apply other fees that are not automated from a system. |

| 168 | ManualAdjustmentDepositViaBankTransfer | This is a debit transaction used from Finance to emulate a payment transfer that is not automatically processed and needs to be manually executed from them. |

| 169 | ManualAdjustmentChargeback | Opposite of 164. |

| 170 | ObligationsPosTerminalSubscriptionFee | This is a debit transaction applied to a customer account as a subscription fee for having a POS card terminal from us. In the form of obligation, meaning that it can be applied on available balance even if the current available funds are not sufficient. |

| 171 | Obligations3GSubscriptionFee | This is a debit transaction applied to a customer account as a subscription fee for data SIM card from us. In the form of obligation, meaning that it can be applied on available balance even if the current available funds are not sufficient. |

| 176 | ObligationsVivaCardOrderFee | This is a fee applied to a customer when they order physical card card for their account with standard activation. |

| 177 | ObligationsVivaCardOrderFeeExpress | This is a fee applied to a customer when they order physical card card for their account with express activation. |

| 178 | ResellerFee | This is a fee applied to our account when we cover a fee for a transaction made at a reseller. |

| 179 | AccountMaintenanceFee | This is a fee applied to a customer when we have to investigate an accoun (e.g. in case of breach of Terms of service or fraudulent activity). |

| 180 | BillPaymentFee | This is a fee applied to a customer who pay his/her bill in the additional Viva Spot points. |

| 181 | TerminationFee | This is a fee applied to a customer when we have to terminate their account (e.g. in case of breach of Terms of service or fraudulent activity). |

| 182 | MinimumClearingFee | This is a fee applied to a customer who has committed a minimum spend with us but have not made it. |

| 183 | IsvAcquiringCommission | This is a credit applied to ISV partner accounts for earning their revenue from customers they enable to accept payments with Viva. |

| 184 | PayPalProcessingFee | This is a fee applied to a customer for accepting payments with PayPal. |

| 190 | PrepaymentLoanDisbursement | This is a credit applied to an account to get in advance funds instead of collecting monthly instalments so they have cash flow. |

| 191 | PrepaymentLoanInstallment | This is a debit transaction applied for repayments of 190. |

| 192 | CashAdvanceLoanDisbursement | This is a credit applied to an account when they get disbured funds for Merchant Cash Advance. |

| 193 | CashAdvanceLoanRepayment | This is a debit transactiom applied for repayments of Merchant Cash Advance. |

| 197 | IrisIssuingPurchase | This is a debit transaction equal to the amount of money a customer spent by using IRIS commerce (DIAS payment method). |

| 198 | IrisIssuingReserve | This transaction is IRIS purchase related and reserves the available balance from our customer between payment authorization and completion of a payment. |

| 199 | IrisIssuingUnreserve | Does the opposite of 198. Used for releasing funds from the available balance. (Example case: account holder decides to cancel a transaction after it has been authorized but not yet completed). |

| 200 | TransfersPlatformAmountSettlement | Specifies the money transfer from platform account to a seller account. |

| 201 | TransfersPlatformFeeSettlement | Specifies the refund of platform fee. |

| 202 | TransfersPlatformAmountClearance | Clerance of Marketplace Transfers between platform and seller. |

| 203 | TransfersPlatformFeeClearance | Specifies the platform fee transfers. |

Get Support

If you would like to integrate with Viva, or if you have any queries about our products and solutions, please see our Contact & Support page to see how we can help!