BANCOMAT Pay

Information on the BANCOMAT Pay payment method.

- Introduction

- User Experience

- Details

- How to activate BANCOMAT Pay

- Merchant Categories

- Payment method messaging

- Get Support

Introduction

BANCOMAT Pay is a payment method available to cardholders using the BANCOMAT mobile application. Our Smart Checkout solution requests from the cardholder to enter the mobile number which is linked to their BANCOMAT Pay mobile application. They will then be able to authorise the transaction within the application.

Some of the main benefits of offering BANCOMAT Pay as a payment method are:

- Flexibility: There is no need for the users to carry bank cards

- Easy to use: Consumers experience a seamless and secure experience, while using in the BANCOMAT Pay app

- Get started quickly: There is no need for the merchant to have an account with BANCOMAT Pay

User Experience

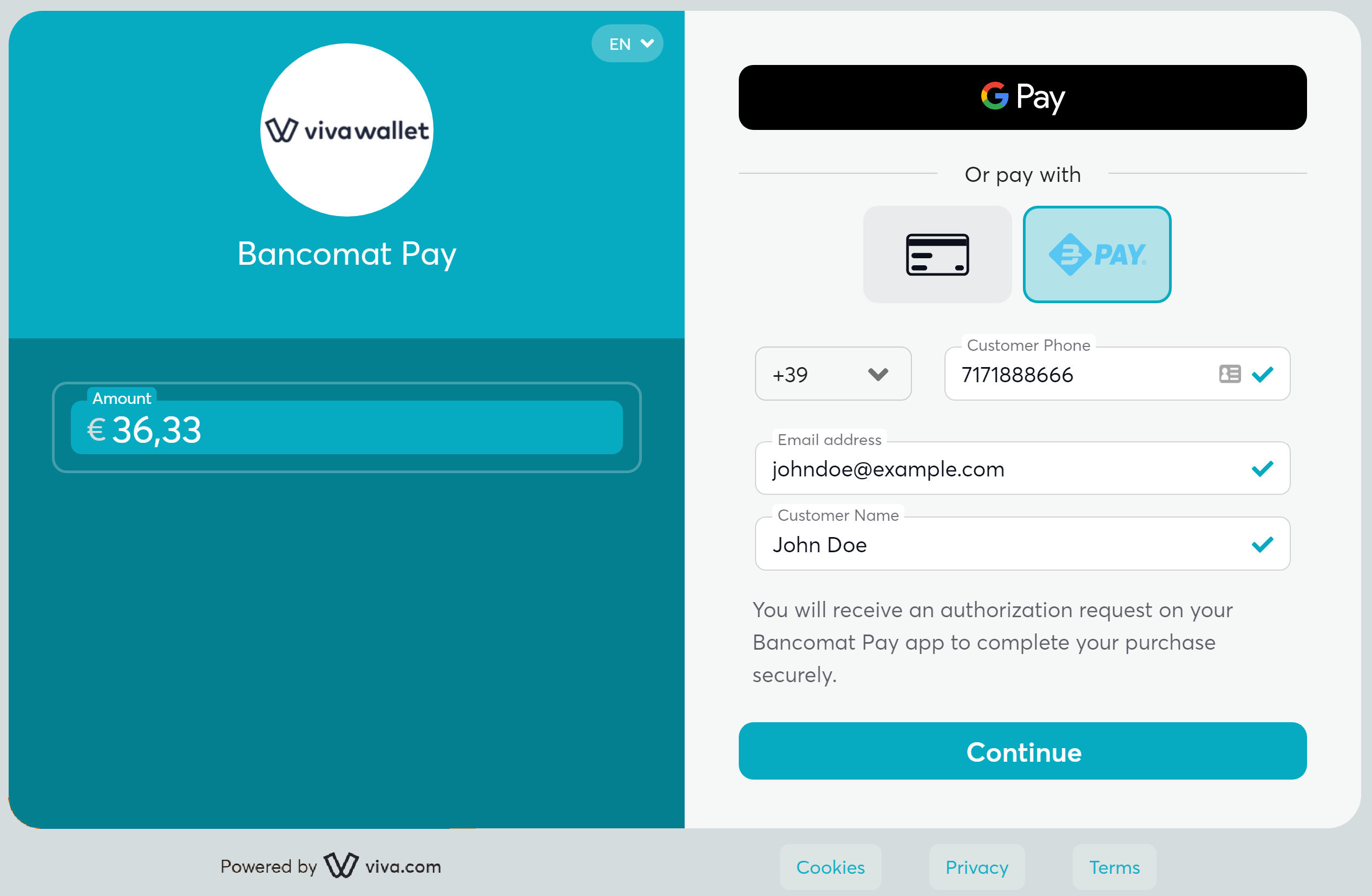

At the online checkout, the customer selects BANCOMAT Pay as their preferred payment method, before filling in their details and clicking Continue:

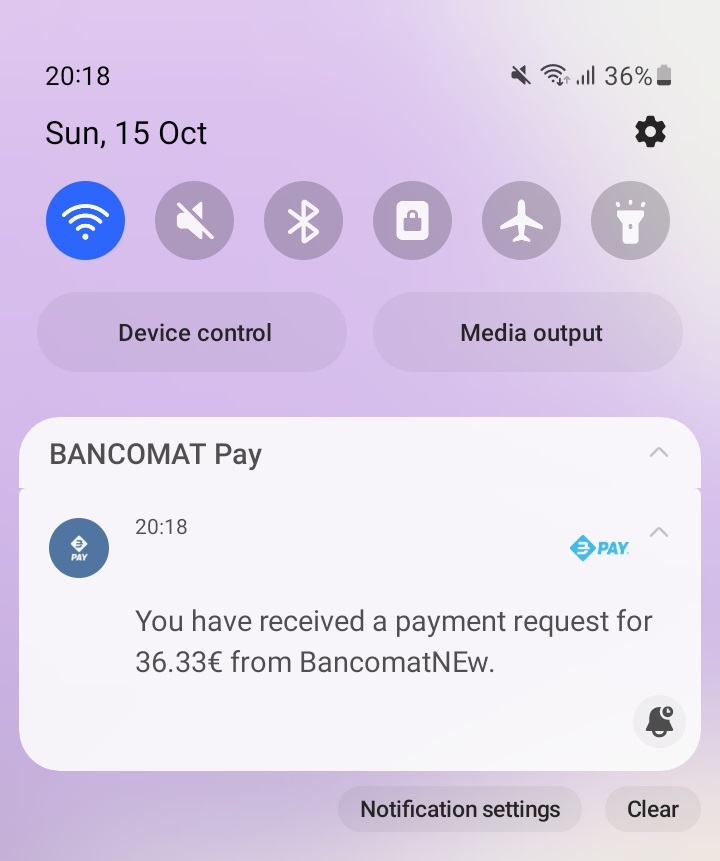

A notification for the payment will then be received on the mobile device on which the BANCOMAT Pay application is installed:

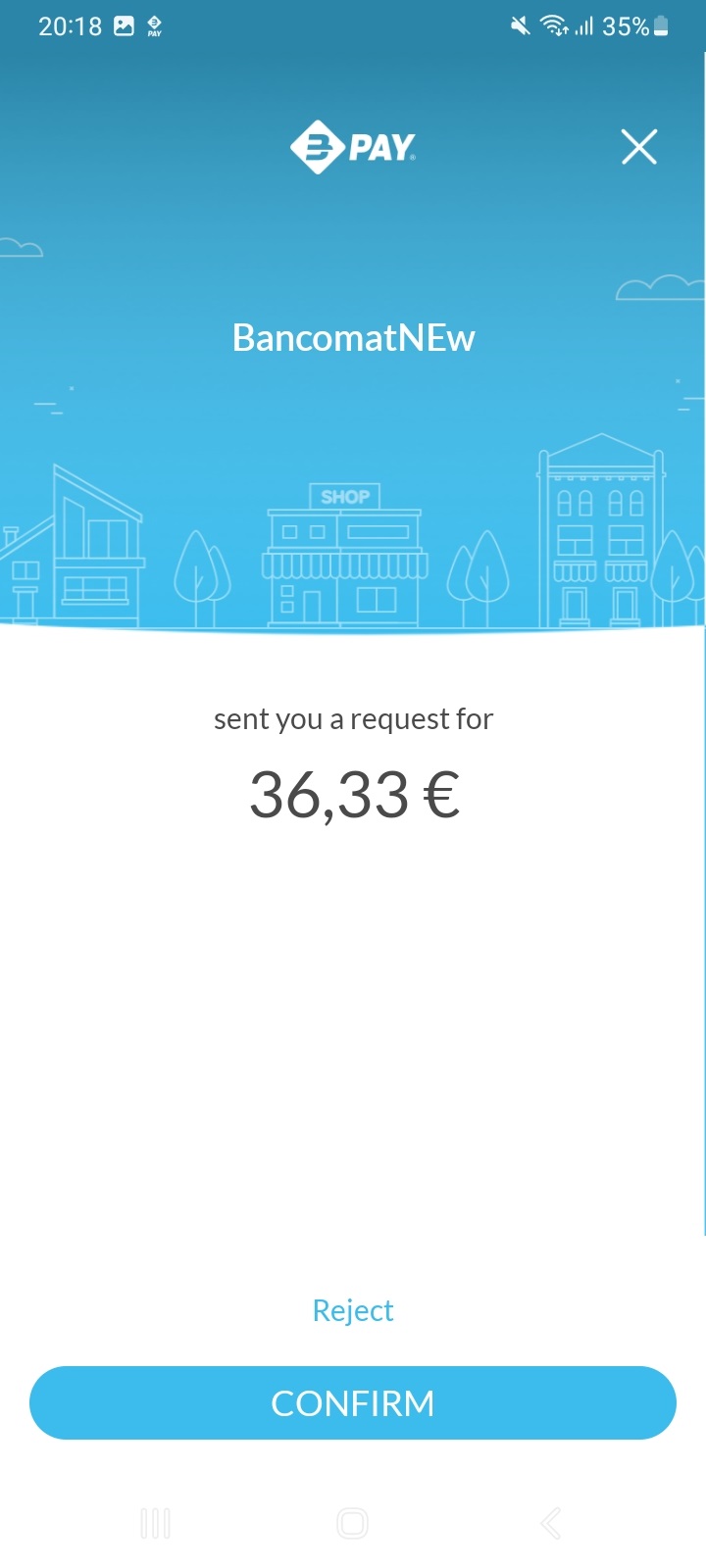

Once the BANCOMAT Pay app is opened, the payment request can be seen and actioned:

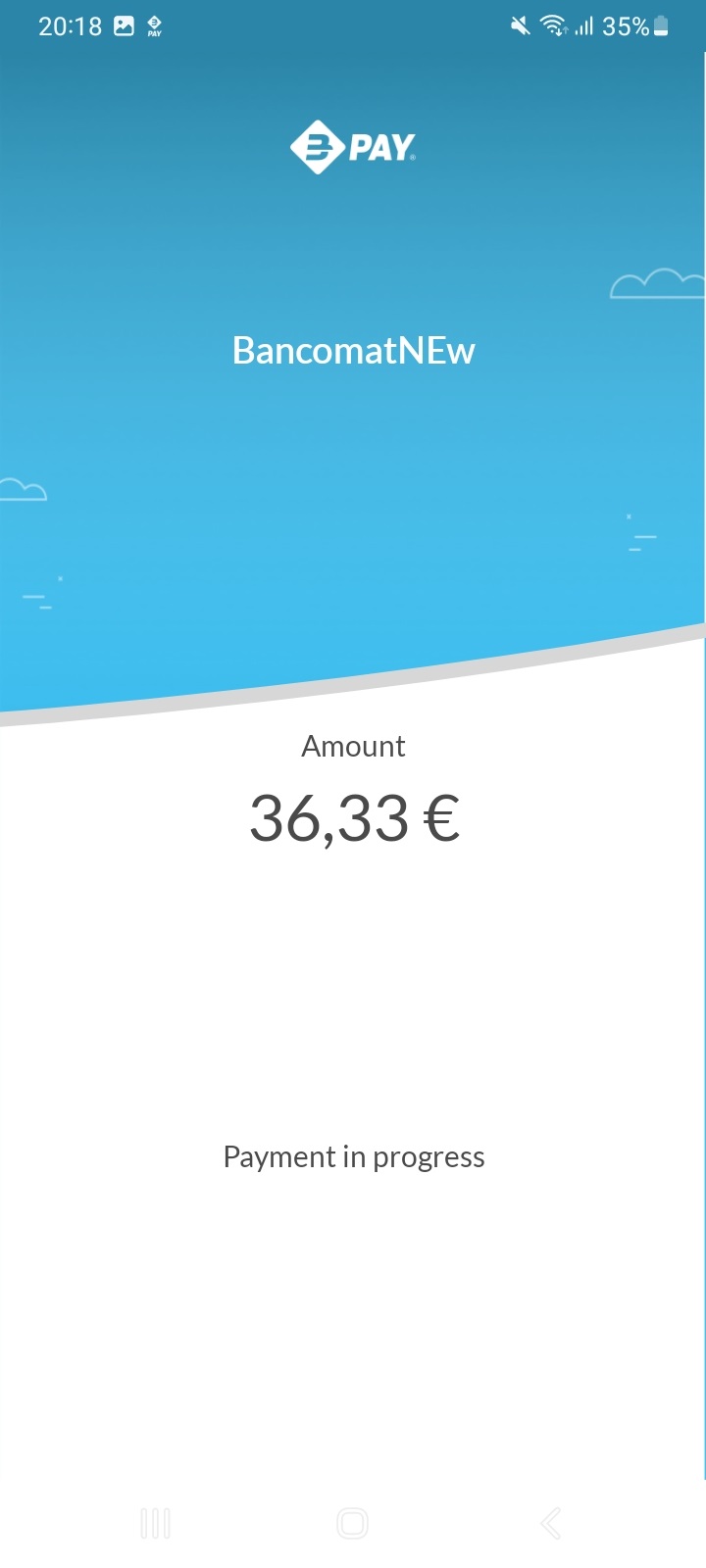

Upon clicking Confirm, the payment will be displayed as ‘in progress’:

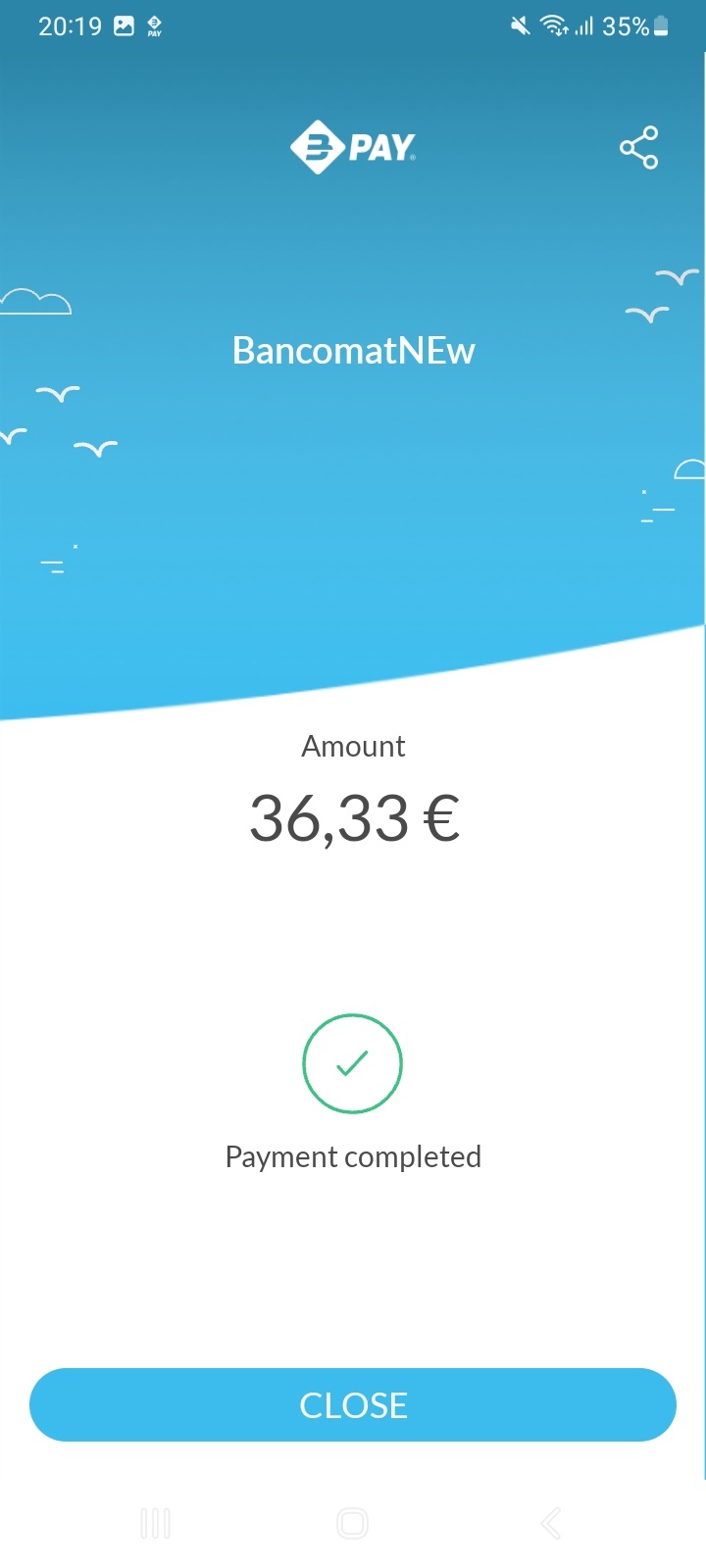

Finally, the application will confirm the payment is complete, and the Smart Checkout payment page will update:

Details

Merchants do not need to have an account with BANCOMAT Pay

- How to activate: Please refer to the How to activate section below

- Payment method type: Asynchronous. You need to set up webhooks in order to get notified for asynchronous payments

- Refunds: Supports partial and full refunds (only one refund is allowed)

- Recurring payments: Not yet supported

- Pre-authorizations: Not yet supported

- Restricted MCC: Some Merchant Categories are not eligible to have BANCOMAT Pay activated

- Μerchant countries: Italy

- Customer countries: Italy

- Pricing: Please refer to our pricing page under the main navigation for more information.

- Settlement: Customer payments are deposited next day into your business account for confirmed payments / successful transactions (i.e. have statusId = F)

- Cross-currency payments: Not yet supported

- Additional notes: BANCOMAT Pay is available through Quick Pay and for payment orders with the

disableExactAmountparameter set to ‘true’. - ISV: Supports ISV Program

How to activate BANCOMAT Pay

Merchants do not need to have an account with BANCOMAT Pay

| Environment | Activation details |

|---|---|

| Production | BANCOMAT Pay can be activated by the merchant. Please see the below steps |

| Demo | BANCOMAT Pay is not available in the Demo environment |

Merchants can only activate BANCOMAT Pay on their own from their Viva account interface. To activate BANCOMAT Pay, please follow the procedure below:

Sign in to your production Viva account .

Click on Settings > API Access and scroll down to the BANCOMAT Pay (Payment Method) section.

Click on the Enable BANCOMAT Pay as a payment method button.

BANCOMAT Pay will be activated

If you would like to deactivate BANCOMAT Pay, click on the Disable BANCOMAT Pay as a payment method button.

Merchant Categories

There are some merchant categories that are not eligible to have BANCOMAT Pay activated. If your business is in one of these categories, you will not be able to accept payments through BANCOMAT Pay:

| Merchant Category (MCC) | Description |

|---|---|

| 7995 | Betting |

| XXXX | Pornography |

Payment method messaging

It is important that the customer is aware of the payment methods you offer via Smart Checkout, as this will increase conversion and average order values. Please see our payment method messaging guide for more details on why and where we would recommend adding this information to your site.

If desired, you can download and use this icon on your site or online store, in order to show customers you offer BANCOMAT Pay as a payment method:

Get Support

If you would like to integrate with Viva, or if you have any queries about our products and solutions, please see our Contact & Support page to see how we can help!